Setting up tax exemptions in WooCommerce doesn’t have to be a manual process. By automating tax exemptions for specific user roles, you can save time, reduce errors, and provide a smoother checkout experience for your qualified customers.

This guide shows you how to implement role-based tax exemptions in two ways: Using dedicated plugins like Tax Exempt for WooCommerce or implementing custom code solutions directly into your site. Both approaches transform what could be a tedious manual task into an automated system that runs in the background while you focus on growing your business.

Which customers might qualify for tax exemption?

Several types of customers typically qualify for tax exemption in e-commerce settings. Understanding these categories helps you set up your WooCommerce store to handle them properly:

- Wholesalers: Companies purchasing products for resale shouldn’t pay sales tax on their inventory acquisitions. Double taxation would occur if they paid tax when buying from you and then collected tax again when selling to end consumers.

- Non-profit organizations: Registered charities and non-profits with 501(c)(3) status (in the US) or similar designations in other countries often qualify for sales tax exemption on purchases related to their mission.

- Government agencies: Federal, state, and local government entities typically don’t pay sales tax on their purchases since tax-funded organizations would essentially be taxing themselves.

- Specialized industries: Many sectors have specific exemption rules including:

- Manufacturers buying equipment for production purposes

- Farmers purchasing agricultural supplies and equipment

- Research facilities acquiring materials for qualified R&D activities

- Educational institutions buying teaching materials

Each exemption category requires proper documentation to verify the customer’s exempt status.

Step-by-step guide to using Tax Exempt for WooCommerce

The Tax Exempt for WooCommerce plugin offers 2 distinct methods for implementing tax exemptions in your store. Both approaches save you time by automating what would otherwise be a manual process. Let’s explore how to set up each method.

Method 1: Customer-initiated tax exemption requests

This approach allows eligible customers to submit tax exemption documentation through their account area:

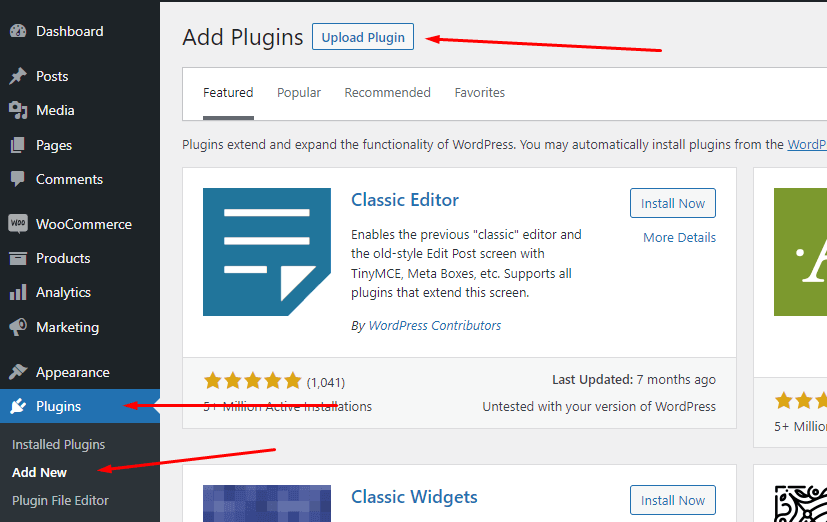

- Download the Tax Exempt plugin from your WooCommerce account, upload it to your site, and activate it.

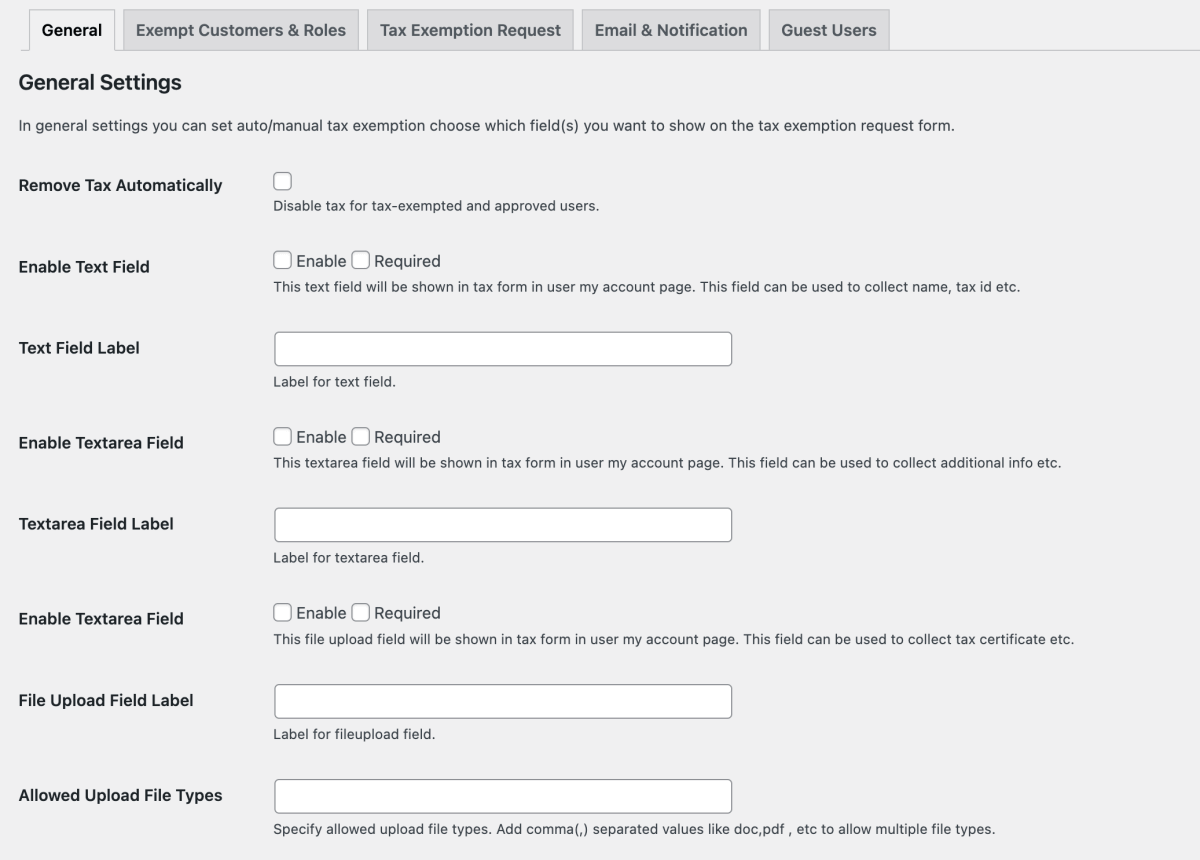

- Go to WooCommerce → Tax Exemption → General to configure your form fields.

- Customize the text fields and file upload options that customers will see.

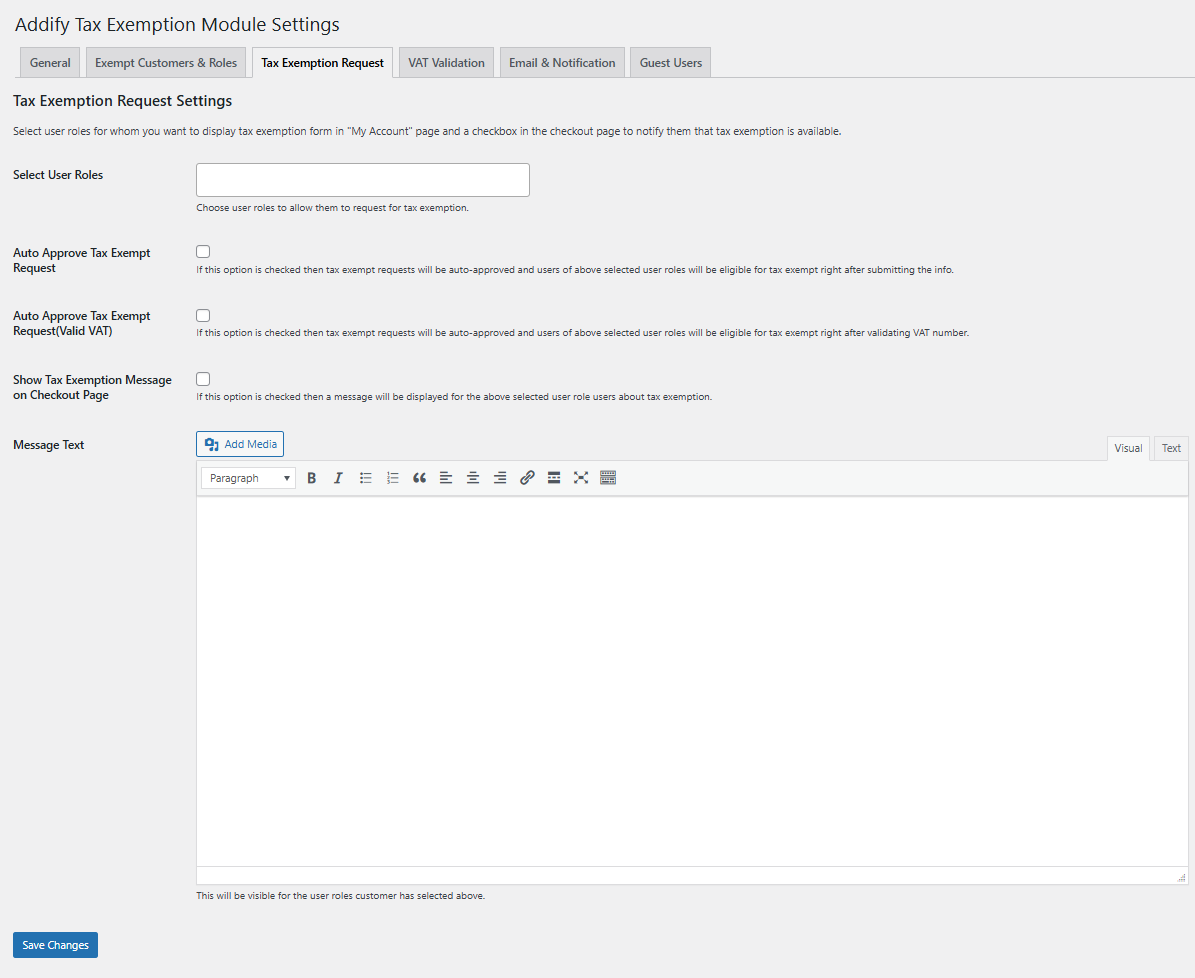

- Navigate to the Tax Exemption Request tab and select which user roles can submit exemption requests.

- Set up email notifications for both admins and customers under the Email & Notification tab.

- When a customer submits their tax information through their “My Account” page, you’ll receive a notification.

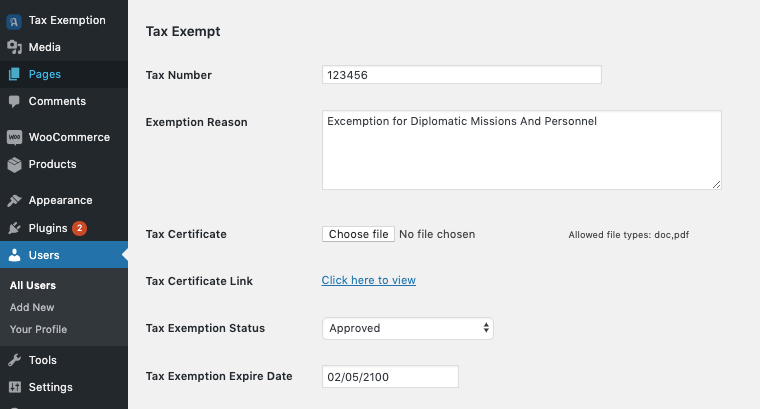

- Review their submission in the user’s profile in your admin dashboard.

- Approve or reject the request and set an expiration date if needed.

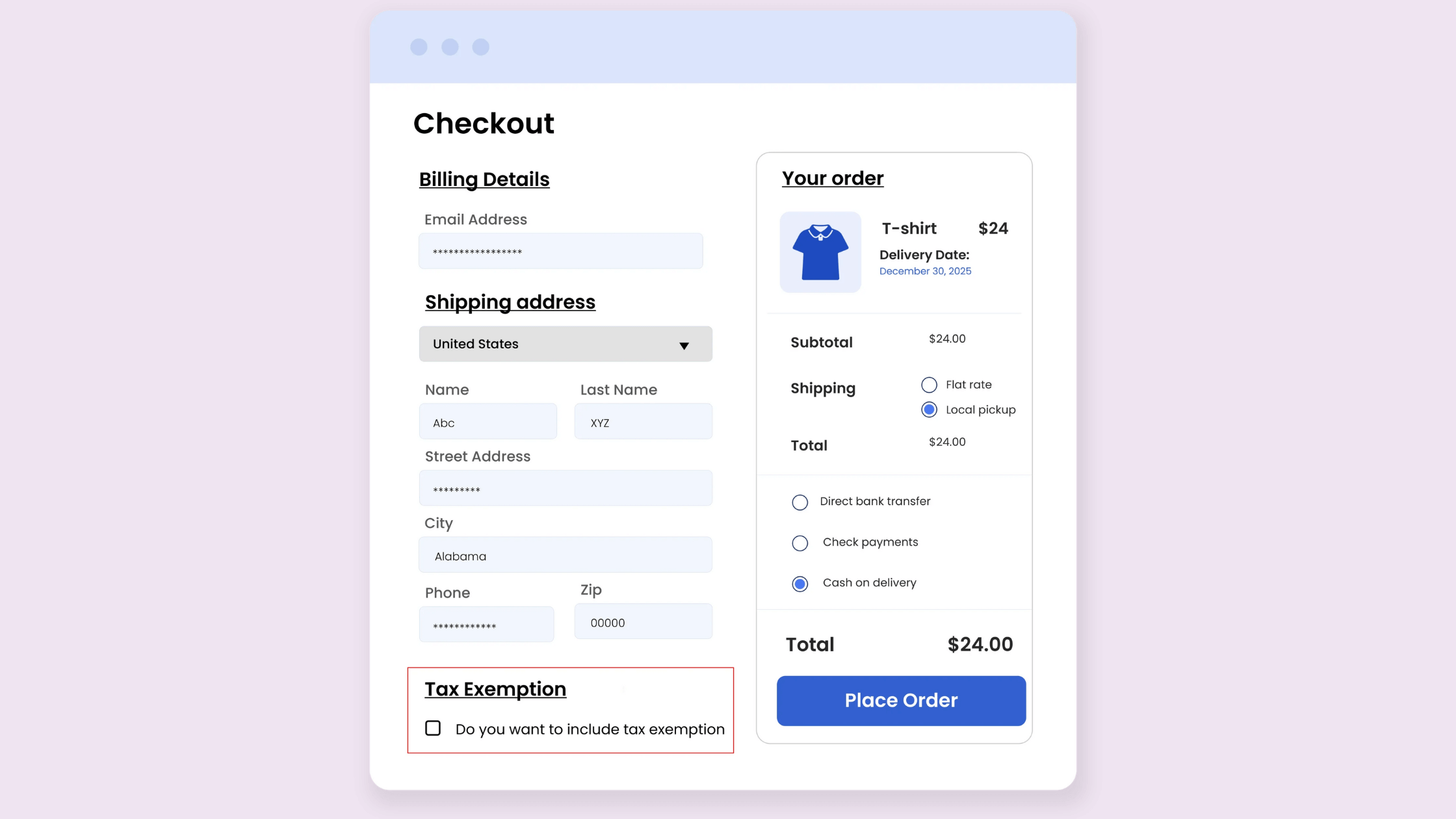

- Once approved, customers can claim tax exemption at checkout via a checkbox.

Method 2: Admin-assigned tax exemptions

This method is ideal for stores with established business customers who you already know qualify for exemption:

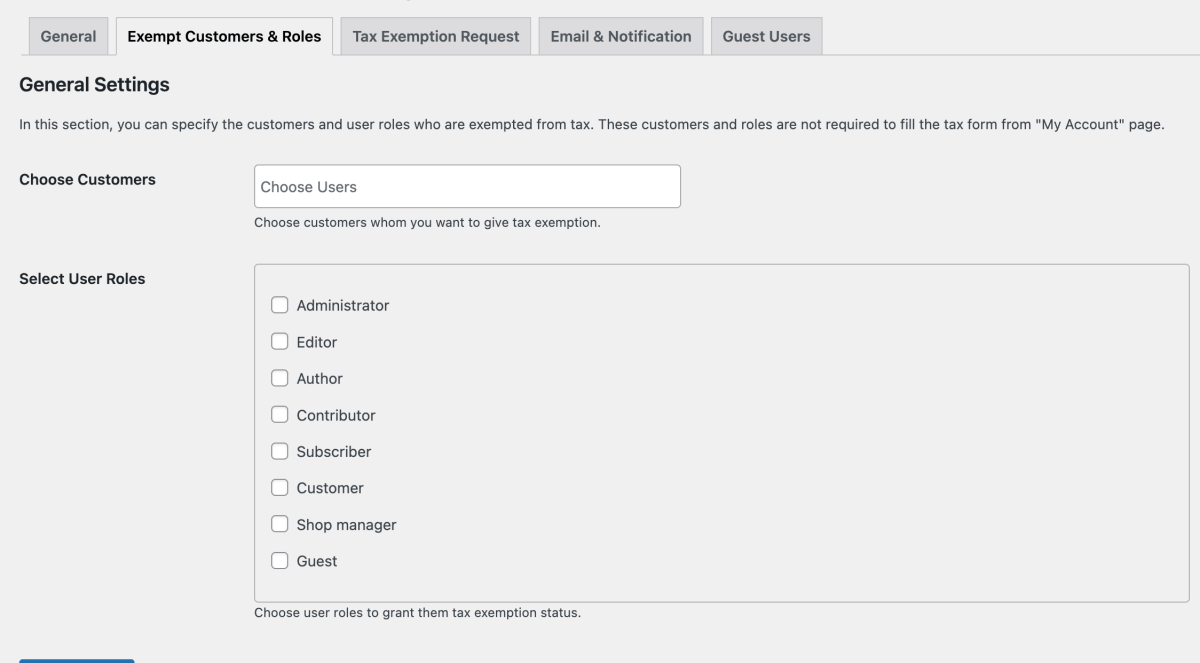

- Go to WooCommerce → Tax Exemption → Exempt Customers & Roles.

- Select specific customers to grant tax exemption status using the customer selector.

- Alternatively, select entire user roles (like “Wholesale” or “Non-profit”) to exempt all users with those roles.

- Choose whether to automatically remove taxes or display a checkbox at checkout.

- If using the checkbox option, customers will need to manually claim exemption for each order.

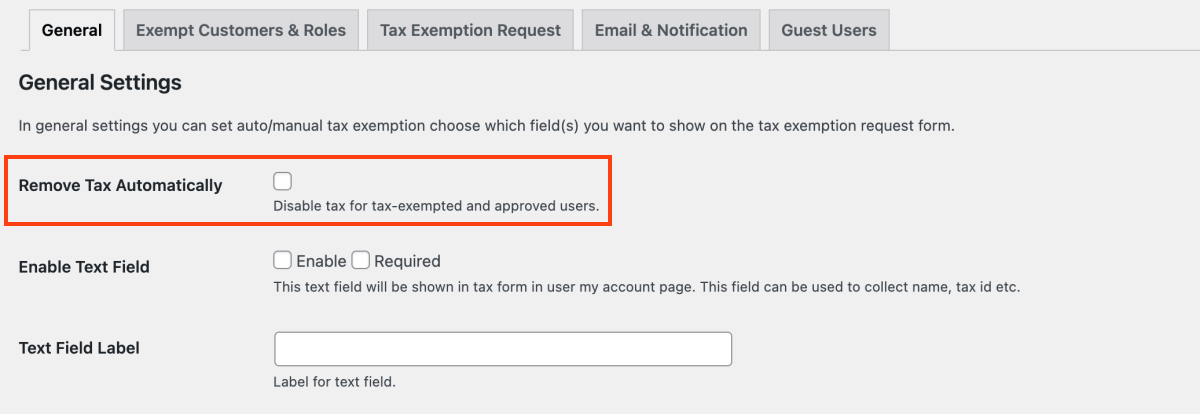

- For automatic tax removal, enable the “Remove Tax Automatically” option under General settings.

The plugin also allows you to display tax exemption information on order pages and in email notifications, ensuring both you and your customers have proper documentation for each tax-exempt purchase. The entire setup process typically takes less than 30 minutes, but saves countless hours of manual tax management.

How to make a user role tax-exempt without plugins

For those who prefer a more hands-on approach, you can implement tax exemptions for specific user roles without installing additional plugins. This lightweight code solution is perfect for developers who want to minimize plugin overhead or need a customized implementation. Here’s how to set up tax exemption for wholesale customers directly in your theme’s functions.php file or a custom functionality plugin.

If you haven’t already created the “Wholesale” user role, you can do it with a quick snippet. This is just an example – you might already have a plugin or code that adds this role, so skip if you already have it:

<code>/**

* Create a 'Wholesale' user role (if needed).

*/

function add_wholesale_role() {

add_role(

'wholesale',

__( 'Wholesale', 'textdomain' ),

array( 'read' => true ) // Capabilities

);

}

add_action( 'init', 'add_wholesale_role' );</code>Code language: PHP (php)Now you can assign users to that role from the WordPress dashboard under Users.

Next, we’ll use a filter in WooCommerce to change the product’s tax class if the logged-in user has the “Wholesale” role. Effectively, we’ll assign a 0% tax class (e.g. “Zero Rate”) to all products for these users.

Make sure you have a Zero Rate tax class defined in WooCommerce → Settings → Tax.

<code>/**

* Exempt tax for the 'Wholesale' user role by setting products to a zero-rate tax class.

*/

function wholesale_customer_exempt_taxes( $tax_class, $product ) {

// Only run if user is logged in and has the Wholesale role.

if ( is_user_logged_in() && current_user_can( 'wholesale' ) ) {

// Make sure 'Zero Rate' is defined in your WooCommerce tax settings.

return 'zero-rate'; // or whatever you named your 0% tax class

}

return $tax_class; // Non-wholesale users keep the normal tax class

}

add_filter( 'woocommerce_product_tax_class', 'wholesale_customer_exempt_taxes', 99, 2 );</code>Code language: PHP (php)WooCommerce will now assign the Zero Rate tax class to products in the cart if the user has the wholesale role, effectively removing taxes for them. This approach offers a clean, efficient solution without the overhead of additional plugins, particularly useful for sites with simpler tax exemption requirements.

Best practices for managing tax exemption certification

Proper management of tax exemption certificates is important for compliance, as well as protecting your business and building trust with exempt customers. Implementing a reliable certificate management system helps you avoid tax audit complications while streamlining the purchasing process.

Here’s what that includes:

- Creating a secure digital storage system with proper encryption and backup protocols. Solutions like DocuWare offer automated processing features that reduce manual handling errors and improve retrieval efficiency.

- Ensuring a consistent verification process that follows a specific checklist:

- Verifying certificate authenticity against official tax authority databases.

- Cross-checking business identification numbers.

- Ensuring all mandatory fields are properly completed.

- Confirming the certificate covers your specific transaction type.

- Establishing clear requirements for your customers:

- Accept only high-quality PDF files for optimal legibility.

- Require essential information like tax ID, business name, and specific exemption reason.

- Set standard renewal timeframes with 30-day advance notices.

- Implement automatic expiration notifications to prevent compliance gaps.

- Conducting quarterly certificate audits to identify and address upcoming expirations and documentation issues before they impact transactions.

- Always maintaining transaction records that explicitly link each exempt sale to its authorizing certificate – this connection is critical during tax audits.

⚠️ Important: Tax regulations vary significantly by jurisdiction. Consult with a tax professional to ensure your processes align with local requirements.

Launch your automated tax exemption system

Setting up tax exemptions in WooCommerce doesn’t need to be complicated. For most store owners, the Tax Exempt for WooCommerce plugin offers the most straightforward implementation with useful features and user-friendly configuration options. The custom code approach works well for developers seeking a lightweight solution for simpler requirements.

After implementation, monitor your system regularly to ensure it’s functioning correctly. Check tax-exempt orders to verify proper tax removal and maintain communication with exempt customers about their experience. You’ll also need to pay special attention to exemption certificate expiration dates to prevent compliance issues.

Finally, watch for common challenges like mixed carts containing both taxable and exempt items, which may require additional configuration. Multi-jurisdiction orders can also create complexity when dealing with customers who have an exemption in one state but not another.

Looking to add more functionality to your WooCommerce store? Studio Wombat offers a range of plugins designed to enhance your e-commerce operations without the complexity of custom development.